Even though voluntary foreclosure doesn’t take place generally, some dwelling-entrepreneurs do simply just hand over on their own property if the worth appreciably drops – this normally occurs in compact towns as well as islands exactly where the tourism is no more Performing.

They can then enter into an arrangement Using the debtor to pay for the judgment or foreclose around the condo. Once the judgment is entered, the probable up coming action is often a garnishment.

As an example, the CC&Rs may state that citizens are unable to go away a garage door open for an prolonged timeframe or demand specific varieties of landscaping. HOA’s are generally formed by the developer with the subdivision or a group of homeowners in the subdivision.

@Rehaan Khan yeah You need to shell out. Sorry, no less than it's a tax deduction. ðŸ˜Â. On the other hand you could possibly endeavor to recoup your losses in tiny claims courtroom. Never employ a lawyer, too expensive. Sue the previous operator for your back HOA dues.

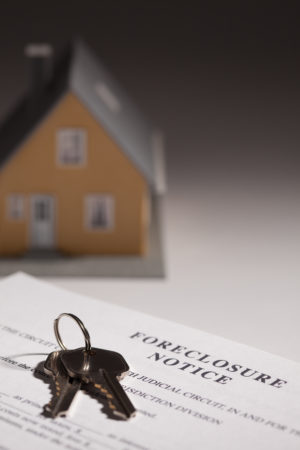

So How can you go about stopping foreclosure? Here's five different methods that may help you avoid foreclosure.

Speak to us now to speak with a skilled financial debt resolution lawyer. We provide exact days appointments and authorized safety. Timetable a

The harm to your credit history rating only takes place if you file for individual bankruptcy. Although it can remain on your file for quite a few many years, credit score scores ordinarily improve following the bankruptcy because the debtor has become furnished aid within the personal debt load. If your credit history rating has risen enough, you may be able to get a home loan right after two several years of a individual bankruptcy.

You may halt a foreclosure by dealing with your We Buy Houses Stop Forelosure lender to request a loan remodification that can set a continue to be about the foreclosure process.

illinois schaumburg chicago real estate agent fha mortgages bob brandt hope for homeowners h4h Remarks 0 New Remark

Affordability as opposed to value: lenders will take a decline over the distinction between the existing obligations and The brand new loan, that's set at 90 per cent of present-day appraised benefit. The lender may possibly pick to offer homeowners with An inexpensive regular mortgage loan payment via a loan modification rather than accepting the losses connected with declining property values.

Your only hope of not paying the many back again charges is to find out In the event the HOA gives a reduction for you in case you pay out each of the back service fees straight away. In some cases they but infrequently.

You may also have the capacity to quit a condo foreclosure by negotiating Along with the HOA straight. In both scenario, it's best to refer to among our Lawyers at Ted Machi & Associates.

The CC&Rs could also present for the gathering of dues, or assessments, that the homeowners should fork out into the HOA to finance the upkeep of widespread regions, for example swimming pools, tennis courts, inexperienced belts, and workout facilities. Commonly, There are 2 forms of assessments that a homeowner should spend:

The home finance loan will have to be refinanced in order to get anyone off the mortgage Nevertheless they nevertheless could very own the home along with you Except if a Give up declare is submitted. Examine with a legal professional about your certain instances.